- Fountain Hills Ties as Safest Zip Code in Phoenix - Oct 14, 2019

- How Many Single-Family Homes in Maricopa County? - Oct 13, 2019

- Investing in Multi-Family Real Estate in Your 20s - Oct 9, 2019

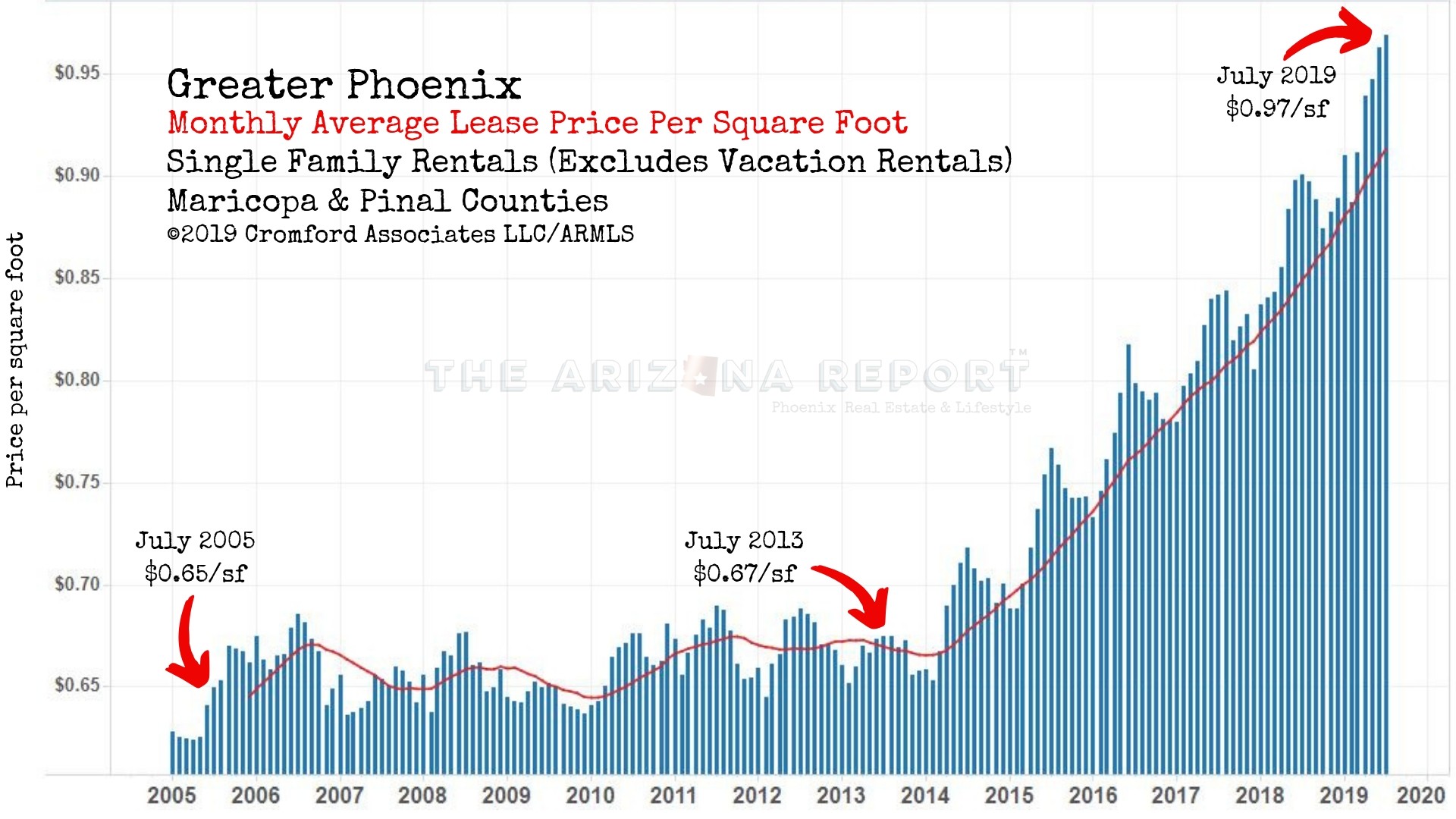

If you purchased a home around the time that the housing market hit bottom in 2011, congratulations are in order. Your timing is amazing. Chances are that your home’s value has since climbed 40% or more in a few short years.

If you made that purchase using an FHA-insured loan that was issued in the last few years, now is the time to consider looking at other mortgage options. Why? You are currently paying for unnecessary mortgage insurance every time you send a check to your mortgage lender.

How much? Using the example of a 3.5% down, 30-year FHA loan for a $250,000 residence, that’s $170.89 per month. Paid to infinity (or until your loan term ends). You receive no benefit from paying mortgage insurance.

What could you do with an extra $2,050.68 per year? It works out to $61,518.75 over the life of your 30-year loan. That’s enough to put a brand-new Jaguar F-TYPE in your garage.

Mortgage insurance protects the bank that gave you the FHA-insured loan in case you were to skip town. You couldn’t opt-out of mortgage insurance when you applied for your 3.5%-down home loan. It’s mandatory for those putting down less than 20%.

FHA mortgage insurance is high. It’s the not-so-glamorous side of the low 3.5% down payment offer.

Furthermore, FHA loans contain not one but two types of mortgage insurance premiums (MIP). Upfront MIP (UFMIP) and annual MIP. The first type (1.75% of the amount borrowed) gets tacked on to the loan amount. As a result, you pay it for the life of the loan. With most FHA loans, that’s 30 years. The latter type, annual MIP, is added to your monthly payment. Double whammy.

The issue at hand concerns those homebuyers who secured 3.5% down FHA mortgages with FHA case numbers assigned on or after June 3, 2013. That’s a cut-off date when a rule change was implemented. FHA homeowners on this side of that date can no longer receive a dismissal of their annual mortgage insurance premiums (MIP). This is true even if the home has skyrocketed in value. Mortgage insurance for these loans has to be paid for the entire 30-year term. Ridiculous, in my opinion. Nevertheless, the FHA’s MMI “slush fund” ran dangerously low during the housing crisis and this is how Congress and HUD are replenishing it.

Back in the glory years, in addition to having the annual MIP component dropped, FHA buyers could even receive a portion of those UFMIP funds back by petitioning the lender. It used to be done with an application, a qualifying property appraisal, and a fee of a few hundred dollars. Those days have passed.

So now that your home’s value has soared and you have plenty of equity, it is time to look at lower-cost mortgage options. Getting rid of mortgage insurance is the goal. MIP is unnecessary when you have a strong equity position. It’s time to refinance out of that aging FHA mortgage.

Thanks to this strong real estate market you have a window of opportunity. A confluence of market factors points to now. Mortgage interest rates are still historically low while home prices have risen rapidly.

Talk to a mortgage lender and look at your conventional loan options. Refinance into a lower payment, shorter loan term, or both. When you reach 20% equity, you can bid adieu to mortgage insurance forever.

Mortgage insurance stocks remained depressed through the end of 2012 amid lingering uncertainty as to whether they had sufficient capital to absorb losses on delinquent loans originated before the crisis. However, as house prices began to recover, losses started to decline.

– John Paulson, American investor and hedge fund manager