- Fountain Hills Ties as Safest Zip Code in Phoenix - Oct 14, 2019

- How Many Single-Family Homes in Maricopa County? - Oct 13, 2019

- Investing in Multi-Family Real Estate in Your 20s - Oct 9, 2019

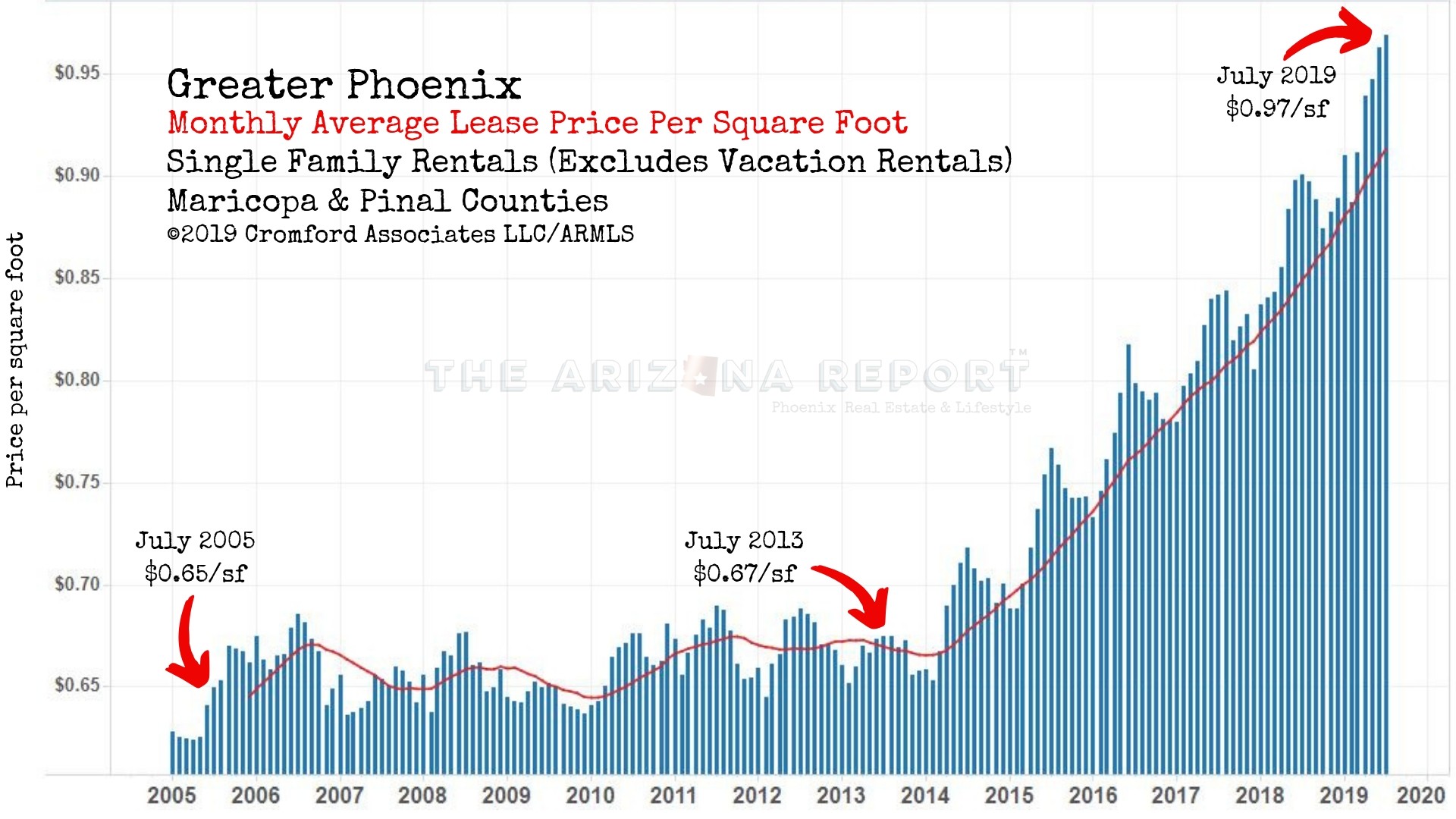

The homeownership rate in the United States has been edging up since 2016. It currently stands at 64.8%. The figure was as high as 69.2% in 2004 when the housing market was fueled by easy credit and no-verification home loans.

That level may be unachievable again in a more sensible mortgage lending environment, but there is still room for millions more renters to become homeowners. So what would be needed to make more Americans homeowners?

In a phrase, relief from debt and more savings.

Freedom Debt Relief commissioned a January 2019 survey of 2,195 American consumers between the ages of 18-65. The results shed light on the obstacles that consumers face on the road to homeownership. Here are some of the findings:

- 38% of those surveyed have less than $1000 in their saving and checking accounts, and 72% have less than $10,000.

- Millennials report that debt makes them very stressed (49%), they’re delaying life goals (44%), are unable to save for retirement (38%), and can’t buy a house (36%).

- More women report feeling stressed about debt vs men (49% vs 42%), being unable to save (51% vs 44%), being unable to buy a house (31% vs 26%) and being unable to save for retirement (41% vs 35%).

- 29% of respondents said that debt was keeping them from buying a house, 35% of GenZ said that debt was keeping them from buying a house, 36% of millennials, 26% of GenX, and 16% of Baby Boomers.

- 41% of those surveyed plan on paying off debt with their tax refund, while 26% plan to put it into savings, and only 7% plan on investing it.

- 46% of those surveyed say that debt leaves them feeling stressed, 40% say that they are delaying life goals, and 12% are delaying having children.

- 54% of respondents said that it would be difficult to very difficult to handle an unexpected $500 expense.

- More than 1 in 5 (21%) said they would give up vacationing for 10 years to get out of debt. Additionally, 22% of respondents said they would give up going out to eat, and 13% would give up the right to vote. Three percent of respondents would give up their driver’s license to get out of debt, 5% would give up the internet, and 6% would give up their phone.

- Only 53% of those surveyed had a “rainy day fund.”

- Almost half (49%) believe that a recession will occur in the next year.

When it comes to credit card debt, 53% of respondents indicated that they carry a balance month-to-month on one or more credit cards. Across all age ranges in the study, the largest use of credit card debt was for daily expenses like food, fuel, and utilities. Higher debt loads reduce the amount of the home loan that a buyer can qualify for and may prevent a consumer from obtaining a mortgage altogether.

Here is how credit card debt load breaks down between the age groups in the Freedom Debt Relief survey:

Freedom Debt Relief is the largest negotiator of consumer debt in the nation. The San Mateo, California firm employs more than 2,200 people at its campus in Tempe, Arizona. Freedom’s Head of Corporate Communications, Michael Micheletti, provided the data for this article.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

– Noam Chomsky, American linguist and social critic