- Fountain Hills Ties as Safest Zip Code in Phoenix - Oct 14, 2019

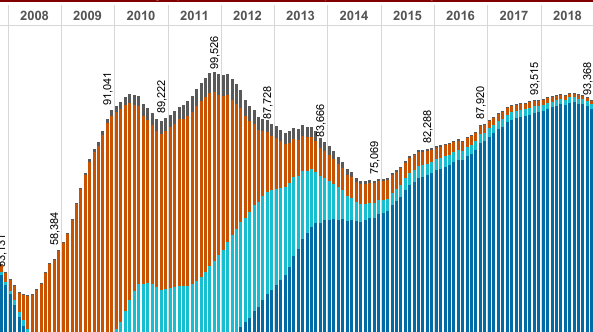

- How Many Single-Family Homes in Maricopa County? - Oct 13, 2019

- Investing in Multi-Family Real Estate in Your 20s - Oct 9, 2019

How the Government Shutdown is Affecting Residential Real Estate

Since December 22, 2018, a partial government shutdown has left the real estate industry in a bind. Approximately 30% of government services are suspended and 800,000 federal employees have been furloughed or continue to work without pay. Essential services, like social security payments, air traffic control

If you are in the middle of certain types of residential real estate transactions, you have noticed delays or complete suspensions of government services essential to the closing of your deal.

The genesis of the shutdown in December was an impasse between President Trump and lawmakers. There was no compromise on a spending bill that would raise the debt ceiling and keep certain departments and agencies open. When the previous spending bill expired on December 21st, nine departments and several agencies were left without the funds required to operate.

The President has rejected requests to approve short-term spending measures that do not include a provision for the projected $5.7 billion needed to complete a wall on the U.S.-Mexico border. Negotiations collapsed. It is now the longest shutdown in U.S. history.

Four of the nine shuttered government departments have a direct and significant role in residential real estate transactions through policy. Those are Housing and Urban

FHA home loans fall under the HUD umbrella. In a letter posted on its website, HUD indicated that a limited number of employees would still be available to process and endorse FHA loans during the closures. However, a truncated staff means that homebuyers could eventually experience processing delays, especially if the shutdown drags on for weeks or months.

Buyers purchasing a condo with an FHA loan will hit a roadblock if the condo development is not already on the department’s approved list. HUD will not be processing condo approval packages from lenders during the shutdown.

According to the memo, the HUD foreclosure website will be maintained and opened for bidding while other FHA functions are shuttered.

FHA-insured reverse mortgages, or HECM loans, are not being funded by HUD during the shutdown.

Veterans who are purchasing or refinancing through the Department of Veteran’s Affairs VA home loan have had little to worry about. VA Secretary Robert Wilkie released the following statement on the day before the shutdown indicating that “all VA operations will continue unimpeded.” Wilkie stated that the VA is fully funded through the end of fiscal year 2019.

USDA home loans guaranteed by the Department of Agriculture have been suspended during the shutdown. Files in escrow have been frozen and not permitted to close. USDA loans offer a zero-down option for buyers primarily in rural areas. There are 1.5 million USDA home loans outstanding worth over $243 billion in the department’s portfolio. No new USDA housing applications are being taken at this time. On average, the department guarantees about 10,000 home loans each month.

In the video below from an NBC affiliate in Columbus, Ohio, a local real estate agent describes the impact of USDA’s funding suspension on her clients.

Notably, the USDA will continue to process incoming escrow payments on its outstanding loans for the payment of property taxes and insurance.

There may be a snag for self-employed borrowers. Lenders need to verify a buyer’s income and withholdings through an IRS service called Income Verification Express Service (IVES). That service initially was closed to lenders when the shutdown began last month. As of January 12th, it is back up and running after lobbying efforts by the Mortgage Bankers Association (MBA). Nonetheless, a backlog still exists as the IRS is operating on a skeleton crew of only 12% of

Buyers seeking conventional loans through Freddie Mac or Fannie Mae channels have largely proceeded unimpeded through the shutdown. These enterprises are in a government

FEMA, under the Department of Homeland Security, originally suspended sales of residential flood insurance policies on December 26th in the wake of the shutdown. The decision was quickly reversed two days later on the 28th. Flood insurance is mandatory on at-risk properties for many mortgage loan types. Approximately 5 million homes in the U.S. are covered by flood insurance policies.

If you are waiting for a tax refund to bolster your down payment for a home, there is good news. Unlike previous shutdowns, the IRS will issue refunds on schedule for taxpayers during the closure. The IRS will begin processing returns on January 28th.

It is not only home buyers who need to be aware of the impact of the government shutdown. Sellers in the middle of a pending real estate transaction should be aware of the type of financing that their buyer is seeking. Review your purchase contract with your Realtor and ask questions about timing and financing delays if your buyer is seeking loan funds from the above sources.

What is the silver lining to the government shutdown? Mortgage interest rates began to drop significantly in mid-December as a result of the anticipated impasse. Uncertainty in financial markets is good for the bond market and puts downward pressure on residential mortgage rates. If you are buying a home and haven’t locked your interest rate yet, there may be an opportunity to clinch a very competitive rate while rates are in this quagmire. Be careful though, because the advent of a announced compromise between Congress and the White House on the debt ceiling will likely send rates up rapidly.

Will your 2019 real estate plans be affected or slowed by the absence of government services? Will it change your motivation to buy or sell? Leave me your thoughts in the comment section below.

I think thegovernment, if you measure it in terms of the dollars out the door, about 83 percent of the government stays open in a government shutdown. Social Security checks go out;military still exists. The FBI still chases bad guys. I think the consequences have been blown out of proportion.

– Mick Mulvaney, Director of Office of Management and Budget (OMB)