Can you hear your neighbors’ conversations through your apartment’s paper-thin walls? Do you step on dog poop as you walk to your car in the morning? Do large amounts of money magically disappear from your account at the beginning of each month, never to be seen again? If so, you are probably a renter.[1] Let’s face it, renting can really stink. Sometimes it literally stinks!

In recent years, Arizonan minimalists have argued in favor of renting because of the flexibility it allows one to pick up and move each year or whenever they feel like it. While there are certainly benefits associated with renting, the advantages and self-fulfillment that come with owning a house are unmatched. But buying your first home can be very stressful. Not only are you making the biggest purchase of your life, but you are doing so under the pressure of real estate agents and brokers who speak a language filled with complex terminology.

Why Buy in Phoenix?

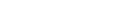

The current consensus among real estate professionals seems to be that housing values in the Phoenix metropolitan area will rise above the national average pace during 2018 and 2019.

While no market is ever completely predictable, waiting too long to buy your Phoenix home will likely result in encountering a higher housing cost down the road. Despite the rising housing prices in the area, Phoenix still remains one of the most affordable metropolitan areas in the United States.

Depending on your specific situation, now might be an excellent time to buy! To make your decision a little less stressful, here are eight randomly-ordered tips that will help you succeed in searching for and purchasing your Arizona home. If you are considering buying a home, please do not rely on this blog alone. Contact a real estate professional and attorney today.

- Figure Out How Much You Can Afford

Before you can really start getting into the nitty gritty of buying a home, you need a reasonable understanding of your price range. This will depend on a number of factors including your credit score, salary, current expenses, and a gauge of how flexible you are willing to be in order to get the house you want. Here is a home affordability calculator to help you get a better understanding on what you can and cannot afford.

- Save Money

At the front end, a home will almost certainly cost more than you anticipate. You can dream about owning your own place as much as you want, but without saving money for a good down payment, closing costs, maintenance, etc. it will not be possible. Given your financial situation, what is a realistic amount of money for you to save? It is common for homebuyers to put 20% down for a down payment, but it is not uncommon for lenders to permit even less depending on the circumstances.

In Maricopa County, the average home will cost you just over $250,000, which means a 20% down payment would cost around $50,000. If you are a first-time home buyer, then you will likely qualify for an even lower down payment. But be careful, lower down payments almost always come at the cost of higher interest rates. To get a better feel for how much you will need to save for a down payment, plug in some numbers on this down payment calculator. It is important to remember that there are other programs that can help you afford a down payment.[2] For example, if you are an Arizona veteran, you will qualify for a Veterans Administration guaranteed mortgage, which allows homebuyers to have low-interest rates with little to no down payment.

- Pick the Right Neighborhood

Did you know that the Phoenix metropolitan area stretches over 9,000 square miles? With countless cities, towns, and neighborhoods here to select from, your decision will be difficult, but you can certainly find something you like. When making this decision, consider your budget, commute, schools (if you have kids), entertainment, culture, safety, etc.[3] Also, while it is easy to look for a home that currently meets your needs, consider your future and whether your prospective home will be a good fit then as well.

To find the best neighborhood for your needs, you need to research, research, research. Once you have narrowed your options down, drive around the neighborhoods, walk around on the streets, and ask potential neighbors what they think about the area. This work will unquestionably pay off in the long run.

- Compare Mortgage Rates with Multiple Lenders

Once you have found a home and are ready to get things moving, you will confront the inevitable: financing. Homebuyers often rush the process of buying a home when they receive their first quote from a lender and realize that a new home is within reach. Before jumping the gun, go to at least two more lenders and make some comparisons. While it may not seem worth the hassle now, comparing mortgage rates will most likely save you several thousand dollars during the first five years of your loan.[4]

- Hire an Experienced Agent You Can Trust

If you decide to hire a real estate agent, meet them in person and feel them out before making any hiring decisions. Do you like them? Do you trust them? Your real estate agent will help you find the right house, but during the process it is crucial to remember that your real estate agent works on commission. If you find a real estate agent you are comfortable with and if you can clearly communicate your goals and desires to them, you will likely have a great experience with that agent and find what you are looking for with ease. If you are ever unhappy about your agent’s services, let them know and they should adapt accordingly.

- Focus on the Big Picture

When your agent is taking you to different homes, you must remember your big picture needs in buying a house. It is easy for certain individuals to get distracted by ugly paint jobs and old wallpaper, but small details like these can be changed quickly and at a relatively inexpensive price. However, bad schools, high crime rates, and long commutes cannot be changed so easily. As you tour through numerous houses, hold fast to your big picture needs and try to forget the small details.

- Making the Offer and Negotiate the Details

The offer stage of the home-buying process is where buyers really witness the magnitude of having a good agent. When you finally find the perfect house, there is a good chance that several other families or individuals have as well. At this point, the seller likely receives numerous offers. You can make your offer stronger than the others by offering more money (even by paying cash, if possible), being flexible with the sellers’ timetable for closing, writing the sellers a personalized letter, and paying additional costs, to name a few.

Even though you are willing to go the extra mile to make a strong offer, that does not mean you should not also negotiate with the seller. After considering the home in its entirety, are there any major repairs that still need to get done? Is the seller willing to pay your closing costs? If the seller is desperate to sell the home, it could be an excellent opportunity to save thousands of dollars. The balance between making a strong offer and negotiating harder is a fine line, but a real estate professional and an attorney can help you get the most out of it.

- Should I Hire an Attorney to Review the Documents I Sign?

You trust your real estate agent, right? Does he promise that everything will go smoothly if you trust him? Well, he’ probably right that things will go smoothly, but “smoothly” and “in your best interest” are two entirely different things. Your agent is probably great, but he cannot give you legal advice. For example, your agent probably cannot assure a clear and optimum title. An attorney is not paid on commission and will bring legal expertise and understanding to the table before you make any life-changing decisions.

While this article lists only 8 things to remember as a home buyer in Arizona, the process is actually far more complicated. The Metro Phoenix market is hot right now and only getting hotter. Depending on your circumstances, it could be an excellent time to get out of your apartment and into a home. If you are considering hiring an experienced attorney to review any contracts or offers for your new Arizona home, contact our office today.

[1] About 40% of households in the United States are renter-occupied.

[2] Federal Housing Administration cuts loan costs; Down payment help for metro Phoenix homebuyers; Program helps renters buy homes certain Arizona cities.

[3] For more advice on choosing a great neighborhood for you, check out https://www.tripsavvy.com/deciding-where-to-live-phoenix-2677611.