- Fountain Hills Ties as Safest Zip Code in Phoenix - Oct 14, 2019

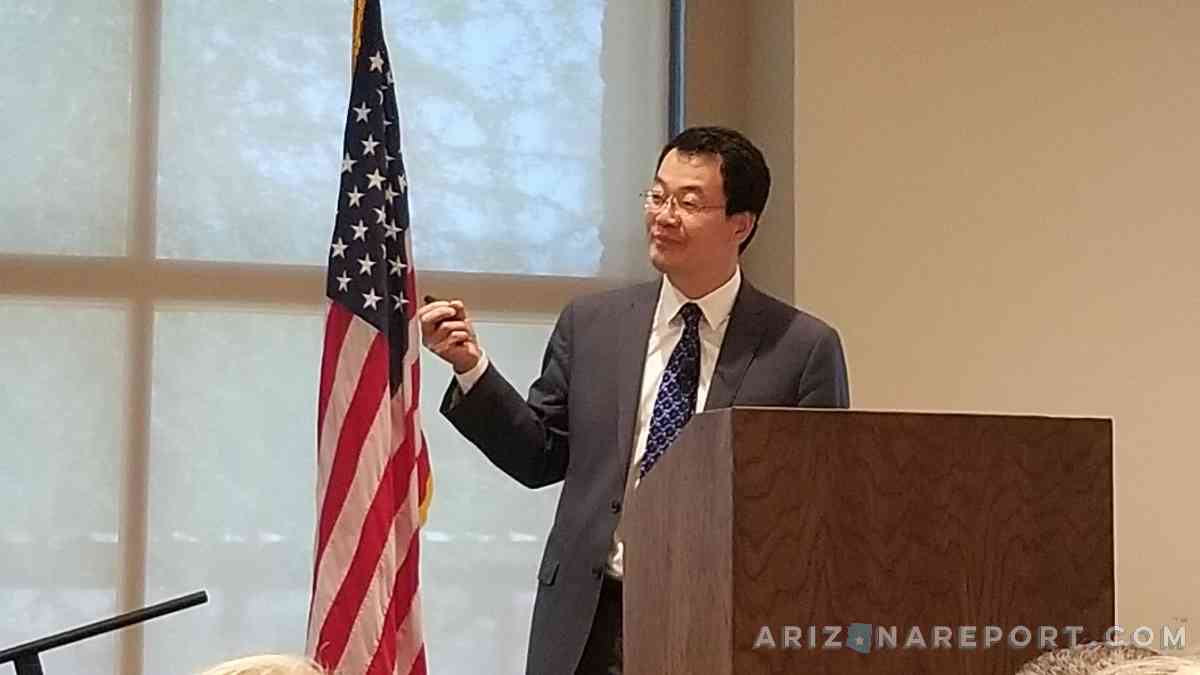

- How Many Single-Family Homes in Maricopa County? - Oct 13, 2019

- Investing in Multi-Family Real Estate in Your 20s - Oct 9, 2019

The top economist for the National Association of Realtors (NAR) presented his market forecast today to real estate agents and vendors in Scottsdale. Dr. Lawrence Yun has served as the Chief Economist for the trade group since 2007. The NAR represents 1.3 million Realtors® nationwide.

Yun said that Phoenix was a unique place to study the housing collapse and recovery because “it was ground zero for disaster for real estate.” This month marks the 10-year anniversary of the Lehman Brothers collapse and the beginning of the rapid implosion of home values in Arizona during the Great Recession.

Recession triggers are not on the horizon at this time, according to Yun’s analysis. An oil crisis, a Federal Reserve aggressively raising rates and a sub-prime mortgage environment have unleashed past recessions. “We don’t have any of those situations at the moment,” he said.

As for mortgage interest rates, Yun said, “It will be a rising interest rate environment, but not alarming.” He projected that 2019 would bring 30-year fixed rates up to 5.5% from their current 4.75% level. Rates rose rapidly earlier this spring, then leveled off over the summer.

Yun tagged Phoenix and Las Vegas as the two hottest residential real estate markets in the country for 2018. “You are in a very good situation,” he said.

The NAR economist cited another prospect for a strong real estate market in the Valley: the number of Californians moving to the Phoenix metro.

Among many points, Yun offered these as reasons to be optimistic about residential real estate in 2019:

- strong demand among a massive generation of Millennials to own a home

- the number of underwater homeowners is disappearing

- hiring across many job sectors is at an all-time high

- the homeownership rate is slowly making a comeback

- if any bubbles exist now, they are in commercial, not residential, real estate

- the absence of sub-prime lending practices

Jobs were a focus of his presentation.”We are in a very rare situation in America today where the number of job openings exceeds the number of job seekers,” said Yun. That bodes well for the housing market in the near term.

However, challenges still exist in the metro Phoenix housing market according to Yun. Among his observations is that housing affordability is beginning to weaken, mortgage interest rates are rising and pending sales are down 1% YTD in Maricopa County.

A headwind on interest rates is the prospect of inflation. “If inflation picks up, lenders need to charge higher interest rates to protect themselves,” said Yun. He expressed that consumers waiting for a lower interest rate environment could be disappointed.

On the whole, prospects for home price appreciation in the Valley look promising according to the NAR’s economist. Maricopa County is the fastest growing out of 3,200 counties in the U.S. “Phoenix should do better than the nation,” said Yun.

The event was hosted by the Scottsdale Area Association of Realtors (SAAR).

.

If you have to forecast, forecast often.

– Edgar Fiedler, American economist