- Fountain Hills Ties as Safest Zip Code in Phoenix - Oct 14, 2019

- How Many Single-Family Homes in Maricopa County? - Oct 13, 2019

- Investing in Multi-Family Real Estate in Your 20s - Oct 9, 2019

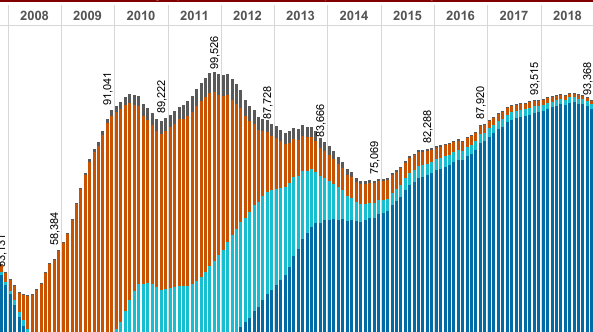

One of the most remarkable stories about residential real estate in the greater Phoenix metro in 2016 has been the dramatic drop-off in the number of sold bank foreclosures and short sales.

Distressed home sales have been a dark cloud over the Valley’s housing stock since the beginning of the housing crisis almost a decade ago. In 2010, nearly 10% of the homes in the Valley stood vacant.

Now distressed sales have slowed to a drip.

As a percentage of all home sales, distressed sales represented only 4.4% of all 7,843 transactions last month in the central Arizona MLS.

According to ARMLS (Arizona Regional Multiple Listing Service), the number of short sales has dropped 15.2% from this time last year. A short sale is where the debts that secure the property are greater than the net proceeds from the buyer’s offer. For example, a short sale occurs when buyers in the market will only offer $200,000 on a home with $250,000 of mortgage debt obligation. The bank agrees to take less than it is owed.

There were only 162 residential short sales in the metro area in August.

Sales of lender-owned bank foreclosure properties as also fell 23.9% in August from the same period a year earlier.

Large institutional investors like Blackstone which led hedge funds and private equity firms in their purchase of tens of thousands of American homes after the crash, have scaled back their purchases and are positioning to sell large swaths of inventory. The large investors see rental rates topping out soon and don’t want to get stuck with inventories or tight margins. Smaller mom-and-pop investors are taking up the slack and working on tighter flipping margins.

Perhaps this precipitous drop marks a point in time where the Phoenix metro can solidly put the housing crisis in the rearview mirror. Maybe it is just a breather. For a variety of reasons, I believe that the national real estate market still has significant headwinds. To read my thoughts on that, click here.

Regardless if the underlying economic issues that created the crisis have been fixed or not, a drop in the number of bank foreclosures and short sales is certainly welcome news.

Chart used by permission. ARMLS. Copyright 2016.

I and others were mistaken early on in saying that the subprime crisis would be contained. The causal relationship between the housing problem and the broad financial system was very complex and difficult to predict.

– Ben Bernanke, served two terms, from 2006 to 2014, as the Chairman of the Federal Reserve of the United States